A Digital Financial institution is an organisation that can offer financial tasks online that were historically only offered at a bank branch. According to the FFIEC (Federal Financial Institutions Assessment Council), e-banking is the "computerized distribution of new and typical financial product or services straight to clients via digital, interactive interaction channels." The 'banking services and products' that this connects to are: Money Down Payments, Withdrawals, and Transfers, Checking/Saving Account Administration, Looking For Financial Products, Finance Management, Paying bills/invoices, Account Providers, Essentially, a digital financial institution must have the ability to give all the financial functions that have generally been lugged out at financial institution head workplaces, branch offices and using charge card at ATM.

Revolut, Monzo, Monese and also N26 can all be categorised as opposition banks as well as are straight competitors of standard financial institutions across the globe. An additional stand-out function of opposition financial institutions is that they have a tendency to enhance the retail banking procedure by leveraging new as well as ingenious innovation. Along with this, challenger banks do have a physical presence, although this is usually rather small.

Neo Banks, The primary distinction in between opposition banks and neobanks is that neobanks do not hold a banking permit however instead depend on a companion financial institution. This suggests that they're incapable to provide some financial services. Neobanks are completely electronic banks that have no physical presence. They connect to consumers by means of mobile applications and also internet systems as well as usually provide extra user-friendly user interfaces and also fee-free services.

An international report on neobanks from Company Insider Knowledge approximates that there were 39 million neobank individuals since completion of 2019. The 7 advantages of electronic financial, There are numerous advantages of electronic financial with neo- and also challenger financial institutions alike. The electronic banking sector is so diverse as well as liquid that new advantages and solutions appear to be emerging regularly.

This indicates that the customer experience and contentment level is miles better than it was previously and many individuals now feel a lot more in control of their financial than ever. Remarkably, this is an advantage sandstone melbourne for the bank that then waterfalls down to the customers. Automated solutions, the lack of physical branches as well as much less workers implies that neobanks and opposition banks have substantially less prices than typical financial institutions.

Digital financial institutions have always made security one of their main top priorities and therefore, have taken on far more innovative and also highly secure procedures than lots of typical banks. The most advanced approaches of in-app as well as repayment authentication are commonly sought after by digital financial institutions and also they offer them to consumers via partners such as Veriff.

Analytics can forecast when customers desire or need car loans when financings default when consumers are preparing to leave, and even when a cross or up-sell will likely be useful. This information, consequently, enables banks to provide highly personalized offers as well as remedies, either through a representative or as an automated deal or solution inside an application or online site.

Below, solutions like self-service, chatbots, and also 24/7 solution deal company advantages while enhancing customer experience. An Emphasis on Adjustment with Bank Digital Transformation While there are several elements of digital makeover in the financial sector, one of the most crucial is readiness and ability to adapt to transform.

The Approachability Void: How to Link with Untapped Consumers50% of consumers wait to approach their banks for services and products. Find out how financial education and learning can aid bridge the space.

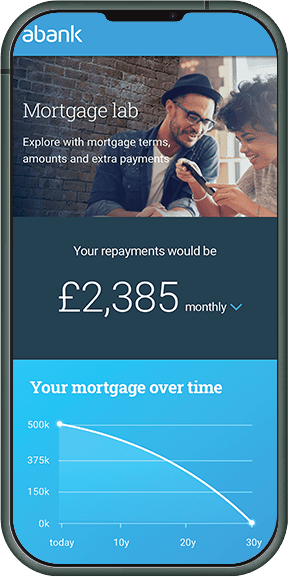

Digital financial incorporates typical banking with the Net. It supplies routine financial solutions, yet on a website or a mobile app. Years earlier, traditional financial embraced the Internet and also created a brand-new way of understanding financial services. In electronic banking, the Web is key in order to open a checking account, transfer funds, set up straight debits, make remote settlements, send remittances and do various other bank operations without visiting a branch.

To take pleasure in the advantages of digital banking just how and also where we desire, all we require is a mobile phone, tablet computer, computer system or any kind of digital device with Web access.

What is Digital Banking? Digital financial is essentially the traditional banking experience going on the internet. Over the past few years, financial institutions all over the globe have slowly transitioned basic activities such as opening up as well as operating a cost savings account to intricate economic services such as managing financial investments to the internet. Physical branches do exist but clients are significantly urged to carry out financial deals digitally, through their bank's site or mobile app.